The willingness to turn to an AI chatbot for something as personal as money could be linked to the increasing normalisation of their everyday use, as well as confidence in the technology at large.

For one, “robo-advisers”, which tap machine-learning algorithms to propose investment portfolios for their users and automate rebalancing, have been around for years.

Communications professional Tan Jiunn Ngee was fresh from signing up with a robo-adviser last year, when he thought of using ChatGPT to reassess his investment-linked policy (ILP).

The policy, which he signed up for in 2019, had been in the red since the COVID-19 pandemic.

“I was inspired after exploring robo-investment platforms that offered automated rebalancing. That got me thinking: Why not replicate a similar process for my own ILP?”

Being able to challenge and talk through assumptions and scenarios with ChatGPT was productive and helped to clarify his thought process, said Mr Tan, a communications professional.

Its suggestions, which included increasing exposure to growth sectors like technology, and diversifying geographically, also seemed reasonable. “Even my financial adviser said it made sense, to some extent,” said the 40-year-old with a chuckle.

But Mr Tan ultimately did not take up ChatGPT’s recommendations wholesale; and was more comfortable letting his financial adviser make the final call. His policy was eventually tweaked to better suit his preference for long-term safe returns.

“I would recommend using ChatGPT as a supportive tool, rather than a decision-maker … because financial planning is just too highly personal,” he said.

Ms Florentyna meanwhile decided that ChatGPT would remain as a learning assistant for her, after spotting errors in its responses such as outdated stock prices and misquoted data from both the web and reports she had uploaded.

“It’s a great tool to bounce ideas. Even now, I still ask ChatGPT what I can do now that I’m older and I am planning for other life goals,” she said.

“AI can give me knowledge, but it doesn’t give me assurance yet.”

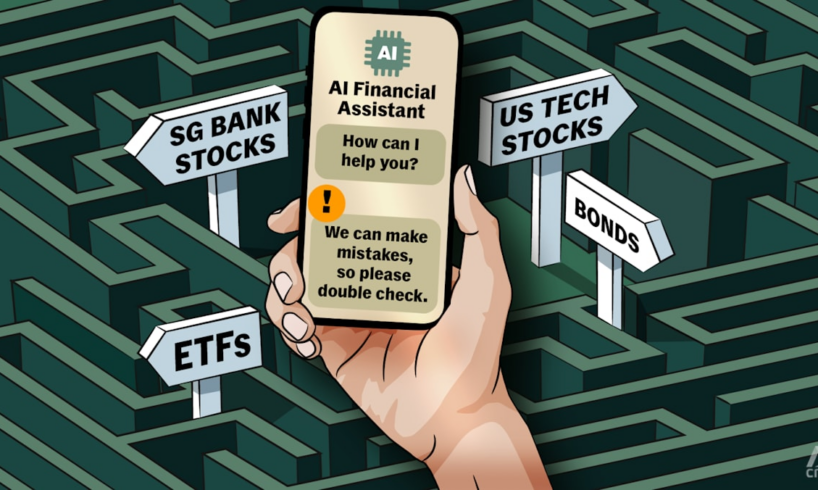

Experts whom CNA spoke to echoed the need to be vigilant, citing accuracy as a key concern given how ChatGPT is primarily trained on massive amounts of past data. This can potentially result in “hallucinations”, where false information is produced.

MoneyOwl’s Mrs Weber also flagged the risk of confirmation bias, noting how generative AI models’ reliance on publicly available information can lead to them reinforcing popular or dominant views.

She cited media reports which posited a link between ChatGPT amplifying “meme stocks” popular on the Reddit forum and the latest rally for such viral stocks.

The quality and nature of ChatGPT’s responses are also heavily influenced by user prompts, said experts.

“If they are not accurate or are flawed in some way, the output will be suboptimal, which could then lead to losses,” said Mr David Gerald, founder-CEO of the Securities Investors Association (Singapore) or SIAS, who urged investors to not solely rely on AI, and to always check with reliable sources before investing.

Mr Poon King Wang, chief strategy and design AI officer at the Singapore University of Technology and Design (SUTD), said it was important to provide the chatbot with clear instructions and contextual information, instead of simply using it like a search engine.

If the advice requires in-depth analysis, users should be using the chatbot’s more advanced reasoning models, instead of the standard models which are better suited for straightforward tasks.

Latest data from OpenAI showed that only 7 per cent of free users were using the reasoning models.

“This suggests that a substantial number of people have yet to fully appreciate how to match the right model of Gen AI to the task to get the right performance,” said Mr Poon.

He noted that for those already using such chatbots like search engines, turning to them for financial-related matters can feel like a “continuation of a habit”.

As money matters are often information-intensive and complicated, chatbots may provide users with “the relief from having something to navigate through it all”, he added.

“What some users forget is that just as not every stock analyst or financial planner or pundit’s analysis is correct, not every response from Gen AI is and will be correct.”

Echoing that, Assistant professor of finance Aurobindo Ghosh from the Singapore Management of University (SMU) noted that chatbots’ ability to offer scenario planning could lead investors to “start believing ChatGPT is a qualified financial advisor”.

“In reality, those results are all based on different analyses of past data or more likely what is available on the web,” he added.

“As we don’t take advice on our finances purely based on websites which are freely available, we should be careful taking advice from ChatGPT or other forms of generative AI.”