NEW DELHI – Singaporean Subra Darma is pining for chwee kueh, a hawker favourite, and missing family and friends after moving to India more than a month ago to drive sales for his company, Akribis Systems, which is looking for opportunities in India’s growing but nascent semiconductor sector.

Based in the southern Indian city of Bengaluru, Mr Darma, India sales director for Akribis Systems India, is adjusting to new food, long commutes and the lack of social support, but remains optimistic about the opportunities ahead.

“It’s very difficult to be efficient as a lot of time is wasted because of travelling,” he admitted.

“But business-wise, it’s very exciting. Akribis has been focused on semiconductors since we started. Now we see in India the kind of opportunity that China had 10 to 15 years ago. The difference is, it’s going to happen much faster here.”

Founded in 2004, Akribis Systems makes high-precision direct-drive motors and precision systems, apart from offering customs solutions for the wafer manufacturing process and testing of chips in the electronics manufacturing and semiconductor industries.

While the company has been operating in India for three years, mainly supplying the mobile phone sector and other industries, it is now tying up with local Indian partners to assemble motors and build equipment for back-end chip testing.

“We have identified some of the local companies,” said Mr Darma.

Singaporean Subra Darma, India sales director for Akribis Systems India, remains optimistic about the opportunities ahead.

ST PHOTO: NIRMALA GANAPATHY

People-to-people and business ties between India and Singapore are strengthening as India races to build a semiconductor supply chain.

Several Singapore-based companies, some of which already have manufacturing operations, are firming up partnerships in the semiconductor sector.

Chips power everything from smartphones and laptops to cars and military systems, with the US$627 billion (S$803.2 billion) global industry projected to exceed US$1 trillion by 2030.

With Taiwan dominating global production, concerns have grown that geopolitical tensions between China and the US could disrupt supply.

A host of countries in Asia, including Japan and Vietnam, are also pushing their semiconductor industries.

The Indian government has declared that India will begin chip production later this year to lower its reliance on imported chips while joining the global supply chain.

Over the past two years, Prime Minister Narendra Modi’s government has approved 10 semiconductor plants, including Micron’s assembly and testing facility in Gujarat, with a goal to grab 5 per cent of the global semiconductor chip production by 2030.

And Singapore, which accounts for 10 per cent of global chip output and 20 per cent of semiconductor equipment production, has emerged as a key partner for India.

This year, Enterprise Singapore found that it didn’t have to convince Singapore-based companies all that much to attend India’s annual semiconductor show, Senicon India 2025, which was held from Sept 2 to 4 in New Delhi.

The number of Singapore-based companies that participated in the trade show rose to 25 from 17 in 2024.

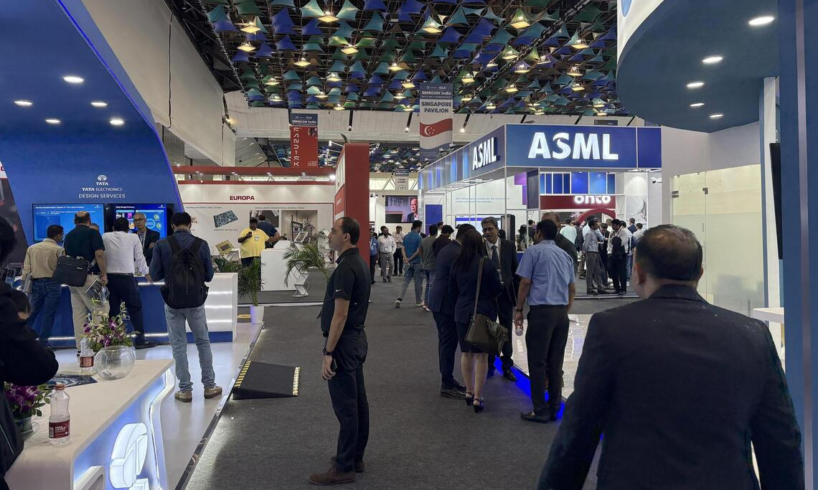

With a banner featuring the Singapore flag hung from the ceiling, the Singapore pavilion was easy to spot amid a sea of booths. Other nations that took part were South Korea and Japan.

Mr Modi, who has noted that chips are “digital diamonds” of the 21st century, visited the Singapore pavilion on Sept 4.

“I think it (the increase in participating companies) just shows that there is a lot of interest from the Singapore community, the Singapore semiconductor industry community, in what’s happening in India,” said Mr Ho Chee Hin, executive director of global markets for South Asia, Middle East and Africa at Enterprise Singapore.

“I actually bumped into many other Singaporeans from the semiconductor industry. Some are exhibitors, some are working for other companies… MNCs. So, actually, quite a big contingent of Singaporeans were at this show, which was a pleasant surprise.”

The Singapore pavilion at Semicon India 2025.

ST PHOTO: NIRMALA GANAPATHY

Singapore has a diverse semiconductor industry developed over nearly six decades, offering services through the entire semiconductor value chain, supplying machinery, chemicals and gases and solutions to the semiconductor majors.

The cooperation between India and Singapore is also being driven by government cooperation. In 2024, India and Singapore signed a memorandum of understanding (MOU), paving the way for Singaporean firms and supply chains to support India’s ambitions. In September 2025, another MOU was signed during the

Prime Minister Lawrence Wong’ visit

to set up a skills centre for advanced manufacturing, including semiconductors, in the southern city of Chennai.

Additionally, the two countries are also working on a “green lane” initiative to simplify semiconductor trade.

Said Mr P. Kumaran, the Secretary (East) in the Ministry of External Affairs at a recent press briefing: “It is a new idea. The aim is to try and optimise the supply chains on the two sides. There is a pilot that they will carry out to study how exactly the supply chains are distributed between India and Singapore, and how to optimise them in a way that risks are minimised, efficiencies are maximised, including logistical efficiencies.”

He noted that Singaporean companies are coming into India to set up semiconductor manufacturing ecosystem clusters for design and fabrication.

To woo foreign and domestic investors, the Indian government has committed around US$7.2 billion since 2021 in incentives under the India Semiconductor Mission, apart from offering tax benefits and land access.

Micron is planning to start producing chips later this year and in June 2025 got government approval to set up a special economic zone over an area of 37.64ha in Sanand, Gujarat, for an estimated investment of 130 billion rupees (S$1.9 billion).

An assembly and testing semiconductor plant being built by Tata Electronics, a venture of the salt-to-software conglomerate Tata Group, is expected to start making chips by 2026, the government has announced.

Taiwanese semiconductor company Powerchip Semiconductor Manufacturing Corporation provides design and construction support to Tata Electronics to build India’s first artificial intelligence (AI)-enabled fabrication plant in Gujarat, according to a company release from Tata Electronics. The two companies have also tied up with Himax Technologies, a Taiwan-based firm in fabless display driver intergrated circuits (ICs) and semiconductor products, to do everything from chip design to chip manufacturing and packaging.

In August, the Indian government approved four separate proposals, worth 46 billion rupees, for setting up semiconductor manufacturing facilities in different parts of the country.

These developments present opportunities for Singaporean firms to set up shop around semiconductor plants.

In Sanand, an entire ecosystem is emerging around the Micron plant.

For instance, Singapore firm Specmax Technologies, a company making equipment for chemical and gas delivery systems for chip manufacturing companies, has set up a warehouse and factory for equipment manufacturing, spread over 10,000 sq ft.

The company’s founder and director, Mr Rajesh, said 15 employees from his Singapore office were among 120 people stationed in Sanand to oversee operations to manufacture equipment for Micron.

While he is in negotiations with Tata Electronics, CG Semi and Kaynes Technology to supply equipment, he is constructing a much larger factory in Tamil Nadu that will span 50,000 sq ft and serve as a supply point throughout India.

“My plan is after March (2026), we are fully focused on the India market. We’re manufacturing all our equipment here and distributing it locally,” said Mr Rajesh, who has been working in the semiconductor sector in Singapore since 2004 and founded his company in 2014.

A key challenge now, he said, is to find investors as he expands in India.

Mr Rajesh, founder and director of Specmax Technologies, said a key challenge now is to find investors as he expands in India.

ST PHOTO: NIRMALA GANAPATHY

For Singaporean firms entering India, the government-to-government cooperation provides reassurance, but doing business is not without challenges.

“The No. 1 challenge is really understanding how India works,” said Mr Ang Wee Seng, executive director of the Singapore Semiconductor Industry Association. He noted this includes the paperwork surrounding importing and exporting of parts.

India offers a large domestic market, a young workforce and incentives covering up to 50 per cent of project costs.

But hurdles remain, from mobilising capital to training talent and further easing of regulations. And since much of the supply chain remains outside India, sourcing materials and parts according to specification of the semiconductor industry, also remain challenges, said those in the sector.

Despite this, Mr Ang predicted that more Singaporeans would gravitate to India as the sector matures, and noted that the city state’s key strength is also its human capital.

“There’s a strong community of Singapore companies. There are people serving these companies. So, I think this is our strength because over so many years, there have been so many Singaporeans who have been trained and are doing good work in the semiconductor industry.”

As India doubles down on its semiconductor ambitions, Singapore is emerging as a natural partner – bringing not only capital and equipment but also expertise, talent and decades of experience.

For professionals like Mr Darma and Mr Rajesh, the shift is both personal and professional – involving new opportunities, new challenges, and perhaps even new homes.

What is certain is that Singapore’s role in shaping India’s semiconductor journey will only deepen going forward.

“We can see clearly there are so many opportunities coming up,” said Mr Rajesh.