Mining billionaire Clive Palmer has been ordered to pay more than $13 million after an international tribunal dismissed his claim of being a foreign investor.

The dispute focused on Western Australian government legislation in 2020, which impeded his ability to pursue $30 billion in damages against the Western Australian government.

The case related to the government’s initial refusal in 2012 to allow him to develop the Balmoral South iron ore project in the Pilbara region.

Mr Palmer claimed the law change was “targeted, weaponised legislation of an unprecedented nature”.

He claimed his financial losses were compounded because he was then unable to sell the project to a Chinese company.

In 2021, the High Court ruled unanimously that the law passed by the WA government to prevent Mr Palmer from suing it was valid.

Having exhausted legal challenge options in Australia, Mr Palmer still had other options under international law.

The claim was brought before the Permanent Court of Arbitration, which is an intergovernmental organisation, by Singaporean company Zeph Investments, which is owned by Mr Palmer.

Mr Palmer sought $300 billion from the Commonwealth in damages.

The case against the Commonwealth argued breaches of the ASEAN-Australia-New Zealand free trade agreement.

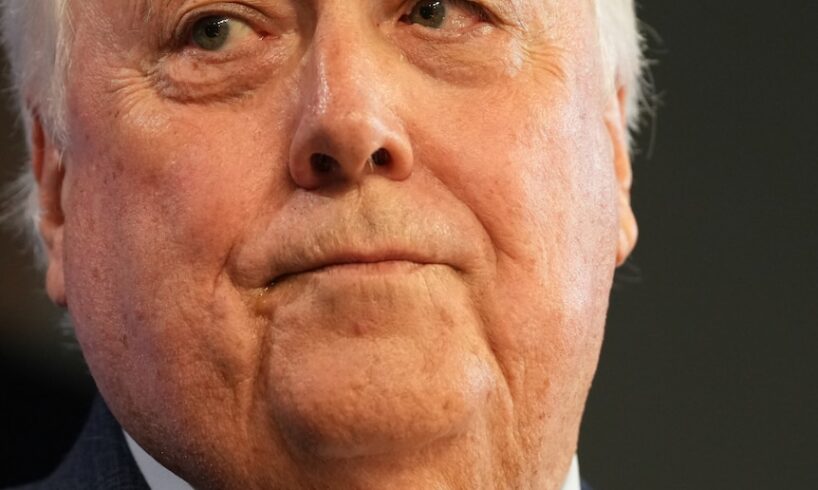

Michelle Rowland has welcomed the international tribunal’s decision. (ABC News: Matt Roberts)

Attorney-General Michelle Rowland said the international tribunal had rejected Mr Palmer’s claim against Australia, finding it had no jurisdiction over the dispute.

She said he had been ordered to pay Australia’s costs of $13.6 million.

“Mr Palmer is not a ‘foreign investor’ and is not entitled to any benefits under Australia’s free trade and investment agreements,” Ms Rowland said.

Decision welcomed by governments

Ms Rowland welcomed the decision, saying the government had “vigorously defended this claim from the outset”.

She said she hoped the decision would see Mr Palmer withdraw remaining international claims against Australia, but that the government would continue to defend them.

Ms Rowland said the government should never have had to spend over $13 million defending the claim.

“The Albanese government remains committed to actively engaging in processes to remove or reform existing investor-State dispute settlement mechanisms.”

In a social media post, Western Australian Premier Roger Cook said the case against Western Australia would have “bankrupted” the state if successful.

“I trust this decision will finally close the book on this long-running saga,” he said.

Senior WA minister Reece Whitby welcomed the tribunal’s decision, saying he believed the matter should now be closed.

“A $300 billion claim has now been determined that there is no case,” Mr Whitby said.

“These are mind-blowing numbers, and I think the tribunal has made a very correct decision that there is no case to proceed further.”

He said Mr Palmer’s initial action against the WA government seeking compensation for the rejection of the Balmoral South mine development, a claim of close to $30 billion, at the time threatened to bankrupt the state.

“It points to the fact that we’ll always defend Western Australia, we’ll always stand up for taxpayers of this state and for our economy,” Mr Whitby said.

A response from Mr Palmer’s office said he would review the judgement.

It is understood he can still seek to challenge the decision through the Federal Supreme Court of Switzerland.

University of Western Australia International Law expert Alvin Yap said the decision was not surprising given the way modern treaties were structured.

“In older generations of investment treaties, there was a concern that an investor could set up a shell company in the foreign jurisdiction and thereby qualify as a foreign investor on those treaties, and thereby enjoy the protection that is supposed to be granted to foreign investors,” Mr Yap said.

“Now, newer generation of investment treaties such as this one, they are very aware of this problem, so they have inserted language to clarify that where a company has no substantial business in the jurisdiction, [that is] it’s just a shell company, it cannot enjoy the protections that should be granted only to foreign investors.”