[Written in partnership with Malaysia Digital Economy Corporation (MDEC), but the editorial team had full control over the content.]

Few apps are as ingrained in Malaysian life as TNG eWallet.

With over 24 million verified users, it has become more than just a way to go cashless. Today, many people use it to save, borrow, insure, invest, and even send money abroad.

That reinvention has now been validated on the global stage. In 2025, TNG Digital Sdn Bhd, the Malaysia Digital (MD) status company behind TNG eWallet, achieved unicorn status with a valuation of over US$1 billion, while also turning profitable.

This milestone caps off a journey that started in 2017 when TNG Digital was founded. 8 years later, the brand has transformed TNG eWallet from a straightforward eWallet into a lifestyle fintech app.

Here’s how the brand evolved and what’s next for them.

From payments to a lifestyle super app

Image Credit: TNG Digital

Not to be confused with Touch ‘n Go (a separate company 100% owned by CIMB Group), TNG Digital was founded in 2017 through a strategic partnership between Touch ‘n Go and Ant Group, AKA the owner of China’s Alipay.

Combining Ant Group’s fintech expertise, TNG Digital launched TNG eWallet a year later to drive cashless adoption in Malaysia. While TNG eWallet initially focused on toll and QR code payments, evolving user behaviour soon pushed the app into broader financial services.

“Malaysians increasingly sought more than just payment functionality. They wanted a platform that could help them save, invest, insure, borrow, and generally make their daily lives more convenient,” said Alan Ni, the CEO of TNG Digital.

In response, the eWallet app expanded its services to meet the demand.

That’s how GO+, a money-market fund, SafeTrip travel insurance, CashLoan, and GOrewards were introduced, transforming TNG eWallet into a comprehensive lifestyle super app.

TNG eWallet’s SOS Balance is a first-of-its-kind practical solution in Malaysia for uninterrupted toll payments even with insufficient balance. / Image Credit: TNG Digital

“The evolution has not only deepened engagement with users but also paved the way for profitability, achieved in Q3 2024, and future sustainable growth.”

Innovation built around real needs

Of the many services offered, several have been pivotal to TNG Digital’s transformation and growth.

TNG eWallet’s GO+ is one that many users would be familiar with. Introduced in 2021, it allows Malaysians to start saving and earning daily returns of up to 3.5% per annum with an investment capital of as little as RM10.

This lowers the barrier to entry for wealth-building and encourages more people to participate in the financial ecosystem. Similarly, TNG eWallet’s CashLoan also makes financing more accessible to the masses.

“30% of our borrowers were previously not in the credit bureau, making it difficult for them to access credit facilities from conventional financial institutions,” shared Swofilen Y. (Filen), Director of Innovation at TNG Digital.

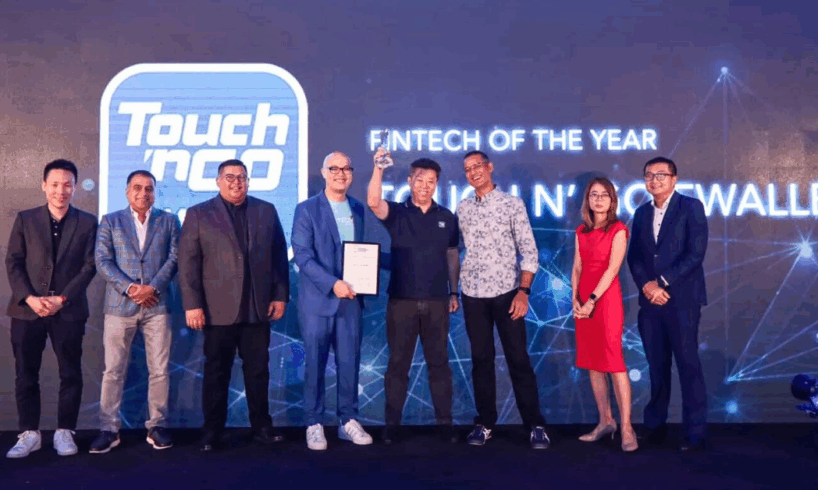

Filen (right) accepted the award for TNG eWallet at the Asia Smart App Awards 2022/2023 in Hong Kong that was co-organised by MDEC, recognised as one of the Best Apps in Asia. / Image Credit: TNG Digital

By offering small and manageable financing, CashLoan helps these individuals formally enter the bureau and start building a positive credit history, opening doors to more credit options in the future.

“Our niche lies in delivering accessible financial services and products that drive financial inclusion. This means making it simple for everyone, even first-time users, to navigate our offerings and lowering barriers to entry so more Malaysians can participate in the digital economy.”

The transition wasn’t without challenges.

Ensuring compliance with strict regulations while keeping products simple required a compliance-first approach. With user safety and confidence at its core, users can rest assured that TNG Digital is regulated by both Bank Negara Malaysia (BNM) and the Securities Commission.

A trusted partner in Malaysians’ daily lives

While the name TNG eWallet remains familiar to users, the app today goes far beyond payments.

Its team develops products with three key criteria in mind: relevance to the daily lives and financial needs of users, solves real pain points, and enhances the existing platform.

“Innovation isn’t just about launching new products; it’s about finding the right balance between user needs and business goals. Sometimes that means introducing something entirely new, but often it’s about continuously improving existing features, so they deliver greater value and a better experience,” Filen added.

Through its Let’s Duit Programme, TNG Digital helped seniors in Kluang, Johor, gain financial literacy through workshops on how to use the TNG eWallet, identify scams, and more. / Image Credit: TNG Digital

This philosophy ensures the app caters to both digital natives and first-time users as well, with advanced features for digital natives layered on top of simple and guided core functions.

Such strategy has paid off, with the brand observing an increasing number of users keeping more funds in their TNG eWallet balance and spending more through the platform.

Filen even shared that a significant number of its GO+ users have maxed out the previous investment limit of RM10,000. This indicated strong demand and, more importantly, user confidence.

It’s what led to the limit increment, so users can now invest up to RM20,000 on GO+.

“We go above and beyond what is required of an e-money platform. For example, BNM mandated five safety and security measures for banks. We implemented all five voluntarily, four months ahead of the banks. This proactive approach reflects our commitment to safeguarding our users’ trust,” Alan shared.

No signs of slowing, only touch ‘n “grow”

Image Credit: TNG Digital

Today, TNG Digital serves over 24 million verified eKYC users, covering 85% of Malaysia’s adult population.

The platform connects users with more than 2 million merchant touchpoints nationwide, processing over RM16 billion in payments each month.

With the brand now also achieving unicorn status (the first fintech unicorn in Malaysia thus far), TNG Digital has grown to become one of the nation’s top consumer fintech service providers.

Part of this achievement can be attributed to TNG Digital’s ongoing collaboration with Malaysia Digital Economy Corporation (MDEC).

“As a MD status company and an active participant in the MDEC Founders Centres of Excellence (FOX) programme, TNG Digital has been able to tap into incentives, rights, and privileges that support the growth of high-potential local tech firms while strengthening its role in the global digital economy,” said MDEC’s CEO, Anuar Fariz Fadzil.

In July 2024, TNG Digital was awarded Malaysia Digital Status by MDEC, highlighting its commitment to advancing fintech talent and industry standards. / Image Credit: TNG Digital

In the years ahead, TNG Digital aims to play an even greater role in connecting people, businesses, and opportunities in the digital economy, helping both individuals and small enterprises grow. All while strengthening Malaysia’s position as a leader in digital financial services.

Although there are no immediate IPO plans, its new unicorn status highlights TNG Digital’s place in Malaysia’s wider ambition to build at least five homegrown unicorns by 2030.

In doing so, TNG Digital not only cements its own position as a market leader, but also raises the bar for what’s possible in Malaysia’s fintech landscape.

Learn more about TNG eWallet here.

Read other articles we’ve written about Malaysian businesses here.

Featured Image Credit: TNG Digital