…Says no return to governments deficit financing

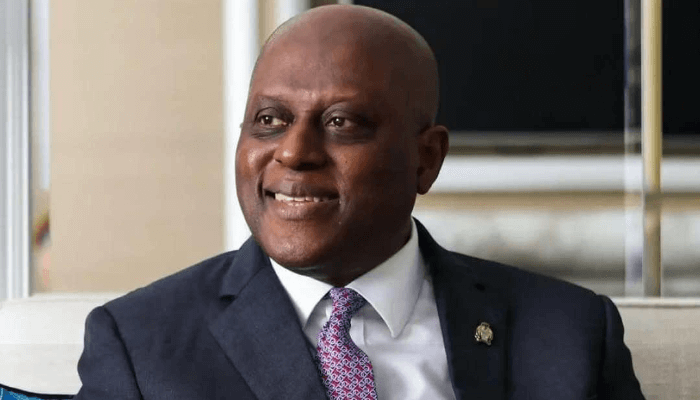

Olayemi Cardoso, governor of the Central Bank of Nigeria (CBN), said on Friday that the bank could resume interest-rate cuts next year if inflation continues to cool.

Inflation eased to 16.05 percent in October 2025 from 33.88 percent in October 2024. Compared to the previous month, inflation fell by 1.97 percent from 18.02 percent in September. Food inflation stood at 13.12 percent in October 2025 from 39.16 percent in the corresponding period of 2024.

“Our models project continued disinflation in 2026, helped by stronger domestic production, improved foreign exchange liquidity, and more disciplined liquidity management,” he told an annual banker’s dinner in Lagos. “As inflation moderates and becomes firmly anchored, we will calibrate the policy rates in line with evolving data.”

Read also: CBN to unveil FX manual to further strengthen market participation, naira

He noted that 2026 will be defined by efforts to strengthen the banking system, protect depositors, deepen financial stability, modernise payments, and reinforce Nigeria’s economic resilience.

He stressed that these priorities directly reflect the CBN’s broader mandate and the direction in which the financial system will be steered in the year ahead.

Cardoso explained that the CBN is committed to safeguarding the stability of the banking sector through rigorous supervision, stronger governance standards, and measures that support sustainable credit growth, emphasising that protecting depositors remains non-negotiable.

He said the bank is equally determined to deliver what he described as ‘durable price stability,’ noting that the inflation-targeting framework will be further refined, supported by advanced analytics capable of anchoring expectations and lowering inflation sustainably.

According to him, the CBN is also prioritising the modernisation of the country’s payment systems and the promotion of financial inclusion, pointing out that digital rails will be strengthened and contactless payments expanded across the economy.

He emphasised that fostering responsible fintech innovation will remain central to the bank’s work in 2026. Cardoso explained that while the CBN intends to support the continued expansion of fintech activity, the institution will also place a premium on consumer protection, cybersecurity, financial integrity, stronger data-governance standards, stricter licensing conditions, and clearer guardrails for digital-asset experimentation.

Cardoso reiterated that the CBN will continue to steer monetary policy with discipline, anchored firmly in the core mandate of maintaining price stability. According to him, stability remains the foundation of an economy where investment thrives, resources are allocated efficiently, and purchasing power is protected.

Looking ahead, he said the bank will intensify engagement with stakeholders, strengthen collaboration with both domestic and international regulators, and continue to foster responsible innovation across the financial system.

Cardoso reiterated that the era of government deficit financing by the central bank has ended. He stressed that the discontinuation of direct deficit financing reflects the bank’s commitment to monetary and fiscal discipline, insisting, “There will be no return to the practice of financing fiscal deficits by the Central Bank.”

He noted that the fiscal authorities are complementing this stance through significant institutional reforms, including the implementation of the Revenue Optimisation framework, the creation of a new National Revenue Agency, and upgrades to the Treasury Single Account, all aimed at boosting revenue mobilisation and strengthening public financial management.

He added that as Nigeria transitions toward a full-fledged inflation-targeting framework, the partnership between fiscal and monetary authorities will only deepen, ensuring that both policies work in harmony to deliver sustainable price stability.

He highlighted that Nigeria’s digital-finance transformation has gathered remarkable momentum in 2025, driven by the CBN’s twin priorities of fostering innovation and safeguarding stability in the payments ecosystem.

Read also: Banks’ OMO cash surge lifts deposits with CBN by 150%

Cardoso recalled that earlier in the year, the CBN had extended its Payment System Vision roadmap to 2028 to accelerate the modernisation of payments infrastructure and bolster cybersecurity across the financial system. He disclosed that more than 12 million contactless payment cards are now in circulation, reflecting strong consumer adoption. He added that the bank’s regulatory sandbox has grown to include more than 40 fintech innovators, enabling safe experimentation and responsible scaling of new digital-finance solutions.

Cardoso also pointed to the strong rebound in foreign capital inflows, disclosing that inflows reached $20.98 billion in the first 10 months of 2025, representing a 70 percent increase over total inflows for 2024 and a 428 percent rise compared with the $3.9 billion recorded in 2023. He described this as clear evidence of resurgent investor confidence.

He said Nigeria’s external sector recorded decisive progress in 2025, with the current-account balance rising by more than 85 percent to $5.28 billion in the second quarter, up from $2.85 billion in the first quarter. He added that foreign-exchange reserves climbed to $46.7 billion by mid-November, the highest level in nearly seven years, providing more than 10 months of forward import cover and significantly strengthening the economy’s resilience.

“Our FX reserves are being rebuilt organically, not by borrowing, but through improved market functioning, stronger non-oil exports, and robust capital inflows.”

Hope Moses-Ashike

Hope Moses-Ashike is an Associate Editor, Banking and Finance, with more than a decade of experience reporting on Nigeria’s financial system and broader economy. She closely tracks market movements, monetary policy decisions, company disclosures, regulatory actions, economic indicators, and global developments, and interprets what they mean for businesses, investors, policymakers, and households. Her reporting helps readers understand complex issues such as inflation trends, foreign exchange market dynamics, interest rate decisions, bank performance, and investment risks.

She also covers major international events and periodically travels to Washington, D.C., to report on the World Bank/IMF Spring and Annual Meetings.

Her dedication to financial journalism has earned her multiple recognitions and invitations to high-level professional development programmes. She is an alumna of the International Visitors Leadership Programme (IVLP) in the United States and holds an Advanced Financial Journalism Certificate from the Press Association Training in London, UK. Her other notable achievements include completing the Lagos Business School CMC Programme, the Bloomberg Media Africa Initiative Programme, and a Master Class in Journalism at Rhodes University in South Africa.