TORONTO — Two of Canada’s wealthiest families have cleared the final hurdle on the road to buying and donating the royal charter that created the Hudson’s Bay Co.

Ontario Superior Court Judge Peter Osborne gave the shuttered retailer permission Thursday to sell the 355-year-old document to holding companies belonging to the Thomson and Weston families for $18 million.

The families plan to donate the charter immediately and permanently to the Archives of Manitoba, the Manitoba Museum, the Canadian Museum of History in Gatineau, Que., and the Royal Ontario Museum.

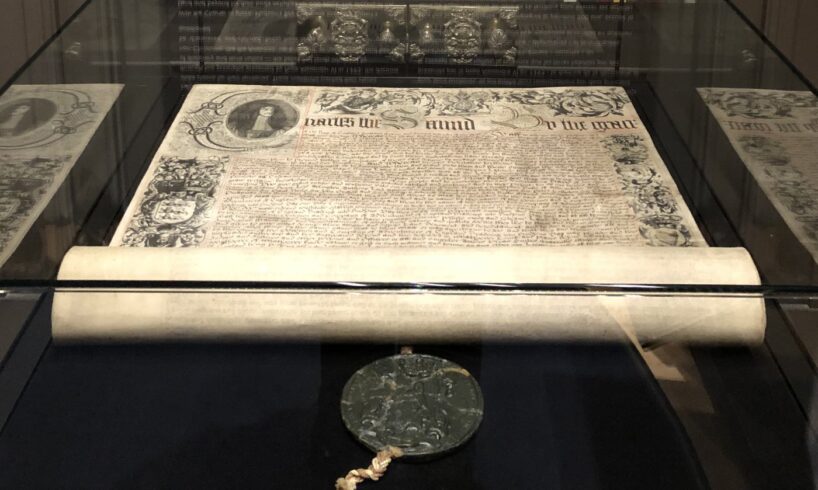

Each of the organizations has already agreed to accept the charter, which was issued by King Charles II on May 2, 1670 and allowed for the creation of HBC, which was then a fur-trading business.

The five-page vellum document was pivotal for the country because it granted HBC control over one-third of modern Canada during its colonization, centuries before Confederation.

It was put up for auction because Hudson’s Bay filed for creditor protection in March and has since closed all of its stores; the defunct company has been selling off its trove of 4,400 pieces of art and artifacts to pay back those owed money.

Osborne approved Thursday an extension of HBC’s creditor protection period to March 31.

The Thomsons, who made their money in the media business, and the Westons, who are giants in the grocery and retail world, were the lone bidders in the charter auction but a court had to approve their joint purchase before it could take place.

The court approval of the charter’s sale ends a saga that has kept HBC lawyers and financial advisers busy for months.

They initially planned to auction off the document before Weston firm Wittington Investments Ltd. stepped forward in July with a $12.5 million offer to buy and donate it to the Canadian Museum of History, a Crown corporation.

HBC was prepared to accept the Weston plan but then David Thomson’s firm DKRT Family Corp. argued it had been waiting for an auction to make its own $15 million starting bid. It wanted the Archives of Manitoba to own the charter.

HBC decided to revert back to the auction plan and let Thomson make the opening bid until both families teamed up to make an $18 million bid.

Reflect Advisors, HBC’s financial advisers, reached out to 150 people or companies to see if they would top the bid. HBC said no one was willing, making the Thomsons and Westons the de facto winner.

“Reflect did its utmost to try to generate a competitive auction, but, when we finally got to that point, in light of the joint bid and the increased purchase price, no one else wanted to participate,” HBC lawyer Ashley Taylor explained to the court Thursday.

Despite the lack of contenders, he said, “We were left, I think, in a very good place.”

Asad Moten, a lawyer for the attorney general of Canada, agreed, saying the Thomson and Weston plan was beneficial because it kept the charter in Canada and ensured it will be accessible by the public.

The charter has been kept in a protective box in storage since the creditor protection case began and before that, was in a private office, Moten said. Before it can be moved anywhere, Moten said the Canadian Conservation Institute will examine it to assess its condition and make recommendations on next steps.

The Thomsons and Westons have said the four institutions they will donate the charter to will be designated “custodians” and will share the document equally. However, the families would like the charter to first go on display in Winnipeg, where HBC opened its first department store in 1881.

How exactly the charter is shared will be decided through a Thomson and Weston-requested consultation process with Indigenous groups, museums, universities, archives, subject matter experts and the public.

However, a term sheet, which was filed with the Ontario Superior Court and signed by the donors and recipients, offers a range of possibilities.

Among them is an arrangement where each institution gets the charter for “rotating multi-year periods on a mutually agreed-upon schedule.” Other organizations not named a custodian could exhibit the charter and unidentified “associated artifacts” as part of a national tour, the document said.

When the charter isn’t on exhibit at one of the four custodian institutions, the term sheet said the custodian organizations could perhaps display high-quality replicas of the artifact.

The term sheet also contemplates a website being created to showcase the charter and digital renderings of other artifacts and documents and periodic symposia being hosted to teach people about the charter “and its significance to the nation, Canadian history, and Indigenous peoples over centuries.”

The Thomsons and Westons have agreed to donate $5 million to help fund these efforts and keep the charter preserved and shared with the public. Future support has also been promised by the Desmarais family and Power Corp. of Canada, along with the Hennick Family Foundation.

The Desmarais family is behind Power Corp., which has a controlling stake in insurer GreatWest Lifeco and IGM Financial. The Hennick family founded real estate firm Colliers International.