“The wider Australian community has a role to play, given normalisation of consuming illicit tobacco and vapes directly supports serious and organised crime.”

Credit: Matt Golding

The commissioner estimates evaded excise to be between $7.7 billion and $11.8 billion. The illicit industry itself, including illegal vapes, is worth $5.7 billion and $8.5 billion. Taxes are so high that they are worth more than the illicit industry, hence the different numbers.

By some estimates, illegal nicotine accounts for between 32 per cent and 42 per cent of the nation’s illegal drug trade.

The report found there were various factors driving the trade.

They include consumer demand (especially among younger people wanting vapes), the price impact caused by high excise rates, tax evasion, money laundering, a lack of consumer awareness about the link between illicit tobacco and organised crime, and insufficient deterrence under current laws.

The commissioner argued that much tougher penalties, an increase in policing and new laws to target the illicit tobacco trade should be on governments’ agendas.

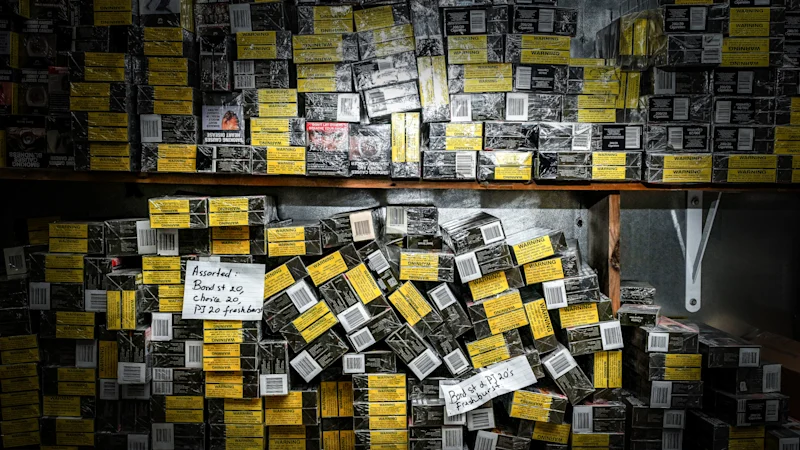

Raids by Australian Border Force officers are finding increasing numbers of illegal cigarettes.Credit: Luis Enrique Ascui

“This could mirror efforts in other serious and organised crime spaces, such as the fight against outlaw motorcycle gangs,” the report found.

Many analysts argue the sharp rise in tobacco excise, which has climbed by 50 per cent since 2020, has been the driving force behind the increase in illicit cigarettes.

But the commissioner warns that a cut in excise, even though it concedes it has contributed to the issue, could cause broader problems.

“Entering into a price competition with the illicit market could lead to adverse health outcomes and undo successive generations of government policy to driven down smoking rates,” the report found.

Loading

But researchers from independent think tank e61, in a paper to be released on Friday, argue a cut in excise has to be considered. Josh Clyne and Lachlan Vass said that while Australia had succeeded in slicing the use of tobacco over a long period, the sharp rise in excise was a major contributor to the growth in the illicit trade.

Even though tobacco excise had doubled over the past decade, revenue from excise had fallen off a cliff. In 2024-25, for instance, excise revenue was $3.8 billion down on initial forecasts.

Clyne and Vass said the rate of excise had gone past the point at which it would maximise the amount of possible revenue for the federal government.

Reducing excise would cut the profit margins for illicit tobacco sellers.

Loading

“The uncomfortable reality is that ‘big tobacco’ would be a likely winner from any such cut. However, the alternative of continuing the current course makes organised crime the winner,” they said.

There is resistance within the federal government to cutting tobacco excise, in part over fears that it could not be reduced enough to encourage smokers to move back to legal cigarettes.

But Sydney University senior lecturer in public health Ed Jegasothy, in a paper released this week, said the issue was not bringing prices down to compete against the illegal trade, but at what point it became manageable to enforce existing laws. He said governments were now trying to suppress a 70 per cent price advantage enjoyed by illicit tobacco.

“This is futile. But if tax reduction brought legal packs to, say, $30, enforcement would face a 50 per cent price advantage,” he said.

“That’s still significant, but potentially within the range where enforcement plus other interventions might actually work. Narrower margins make enforcement viable; current margins make it impossible.”

Cut through the noise of federal politics with news, views and expert analysis. Subscribers can sign up to our weekly Inside Politics newsletter.