By moving to fire a Federal Reserve governor, Donald Trump has forced courts—and markets—to confront a question America has dodged for more than a century: who truly controls U.S. money? The outcome could either confirm presidential authority or cement the Fed’s autonomy, with consequences for global finance.

In Washington, few institutions inspire as much awe—or as much suspicion—as the Federal Reserve.

For decades, its chairmen and governors have moved global markets with a single sentence, raising or cutting interest rates without any direct check from voters or even from elected officials.

It is the world’s most powerful central bank, the beating heart of the dollar system on which the globe depends. Yet rarely has anyone dared to question its constitutional legitimacy.

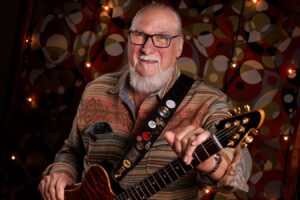

Trump vs. the Fed: The Showdown For Control of the World’s Most Powerful Bank. (Photo Internet reproduction)

Now, Donald Trump has locked horns with it directly. In a move unprecedented in U.S. history, the president—now in his second term—has attempted to fire a sitting Federal Reserve governor, Lisa Cook, citing alleged mortgage irregularities.

Cook, the first Black woman on the Fed’s Board of Governors, has refused to resign, and the matter is barreling toward the Supreme Court.

At stake is not simply her future, or Jerome Powell’s authority as Fed Chair, but something far larger: who really controls America’s central bank, whether it is constitutional, and whether a president can pierce its shield of independence.

This is not just an American domestic dispute. The Fed’s decisions determine global capital flows, dictate the fate of emerging markets, and influence whether nations from Brazil to Bangladesh can borrow affordably or must endure punishing debt spirals.

The showdown between Trump and the Fed is, in fact, the most consequential confrontation in world finance in generations.

The Fed’s Untouchable Mystique

Created in 1913 amid the Progressive Era, the Federal Reserve was sold as a compromise: a central bank that would combine public oversight with private initiative, regional diversity with national coherence.

It consists of a Board of Governors in Washington and 12 regional Federal Reserve Banks scattered across the country. Together, they form the Federal Open Market Committee (FOMC), which meets eight times a year to set interest rates and control the money supply.

But its structure is unlike any other U.S. agency. The seven Board governors are presidential appointees confirmed by the Senate.

Yet the regional Fed presidents—who hold powerful votes on monetary policy—are selected largely by private directors, not elected officials.

These directors need not be bankers or politicians. Their names are barely known. They rotate into the FOMC, quietly determining the price of money worldwide.

The President cannot appoint them. The Senate cannot confirm them. And neither can remove them. This design, critics argue, places immense power in the hands of people the public never chose.

The Constitutional Puzzle

The U.S. Constitution is clear: Congress has the power “to coin Money \[and] regulate the Value thereof.” Nowhere does it authorize an independent central bank. Indeed, the Founding Fathers feared concentration of financial power in the executive.

Early debates over the First and Second Banks of the United States highlighted this tension. Jefferson and Madison argued national banks were unconstitutional; Hamilton and Marshall insisted implied powers allowed them.

The Fed’s defenders rest their case on the Necessary and Proper Clause, which allows Congress to create institutions needed to execute its powers.

By this logic, the Federal Reserve Act of 1913 was valid. Yet opponents counter that Congress cannot simply delegate away its core responsibility over money to an unelected body.

When it did so in 1913, and expanded the Fed’s autonomy in 1935, it effectively relinquished one of the Constitution’s most fundamental levers of democratic accountability.

In Trump’s framing, this is a betrayal: How can courts insist that a president cannot unilaterally set tariffs, while shrugging as the Fed dictates global monetary policy with no direct oversight?

Trump’s Gamble: The Lisa Cook Case

Trump has seized on Lisa Cook’s alleged double-declaration of “primary residences” on mortgage forms as the lever to pry open the Fed’s armor.

It is, on its face, a narrow dispute—something closer to a technical ethics issue than a scandal. But Trump has transformed it into a constitutional test.

The Federal Reserve Act says governors serve 14-year terms unless “removed for cause by the President.” No president has ever invoked this clause.

Trump argues that Cook’s alleged misrepresentation qualifies as cause and that his authority in this matter is non-reviewable. Cook argues the opposite: that her firing is a pretext, an assault on Fed independence, and a violation of due process.

If the Supreme Court sides with Trump, it could shatter the norm of Fed untouchability. If it sides with Cook, it will codify the Fed’s independence in a way the Constitution never envisioned. Either way, clarity will replace ambiguity.

Independence or Unaccountability?

The Fed’s independence has long been hailed by economists as essential to stability. Freed from political cycles, the central bank can act in the long-term interest of price stability, rather than cutting rates to win elections.

But independence can also mean unaccountability. The Fed has never undergone a full external audit. Its regional presidents, wielding federal power, are appointed through processes alien to democratic norms.

And it has presided over blunders: tightening money during the Great Depression, fueling inflation in the 1970s, and enabling unsustainable government debt with zero-interest policies after 2008.

As Trump ally Jeffrey Tucker has put it, independence is just another word for being “unaccountable.” And unaccountability in a democracy is dangerous.

Who Holds the Leash?

The core question is simple: Who controls the Fed?

Congress? It created the Fed, sets its mandate, and could, in theory, abolish it. But since 1977, Congress has largely stepped back, leaving the Fed to pursue its “dual mandate” of price stability and maximum employment.

The President? He appoints governors, but only gradually shapes the Board. He cannot dictate policy. Until Trump, he did not dare test removal powers.

The People? Indirectly, only through the electoral accountability of Congress and the White House. But in practice, monetary policy has been walled off from public influence.

The truth is unsettling: the Fed is accountable to no one in a direct, democratic sense.

Central Bank

Who Appoints Leaders

Mandate

Accountability Mechanism

Independence Level

Federal Reserve (US)

President (Board); private boards (regional presidents)

Price stability + employment

Testimony to Congress; vague oversight

Very high

ECB (Eurozone)

EU Council appoints Executive Board

Price stability only

EU Parliament hearings, treaties

Extremely high

Bank of England (UK)

Chancellor appoints Governor

Price stability, growth

Parliament oversight, Treasury reserve powers

High

Bundesbank (Germany)

Federal Government appoints

Stability of mark (pre-euro)

German law, political culture

High (historically)

A Global Comparison

Other central banks face similar critiques. The European Central Bank is famously independent, but its mandate is narrow: control inflation.

The Bank of England regained independence in 1997, but Parliament can legislate to rein it in. The Bundesbank was fiercely independent, but always tethered to Germany’s political framework.

The U.S. Fed, by contrast, occupies a grey zone—a hybrid of public and private authority, wielding vast global power, with ambiguous constitutional grounding.

Why the World Should Be Grateful

For over a century, Americans and the world have accepted the Fed’s independence as gospel. Few have dared to question its legitimacy, let alone test it in court. Trump’s gambit, whatever one thinks of his style, is forcing that reckoning.

If he succeeds, America will know once and for all that the Fed is subordinate to elected authority. If he fails, the courts will explicitly enshrine its independence, and the people will at least understand the truth: their representatives gave up control of money in 1913.

Either outcome is preferable to the murky status quo. The world, too, should be grateful. Global markets depend on the dollar, and thus on the Fed.

For decades, that power has been exercised behind closed doors. By challenging the institution, Trump is compelling America to clarify who is truly responsible for the monetary order. Accountability, whether to the President or to Congress, will bring legitimacy.

As Mark Levin observed, America has drifted into a “post-constitutional” era where agencies act without clear foundations. By forcing the question, Trump may restore the primacy of the Constitution.

It is an irony of history: a man often accused of destabilizing institutions may be the one who finally stabilizes the most powerful of them all—by clarifying its rightful place.

In piercing the aura of the Federal Reserve, Trump has ensured that America—and the world—can no longer pretend not to know who controls the money. For that, the world may one day thank him.