By Ahmed Tabaqchali, Chief Strategist of AFC Iraq Fund.

Any opinions expressed are those of the author, and do not necessarily reflect the views of Iraq Business News.

“A Ho-hum Month, Ahead of Elections”

The market, as measured by the Rabee Securities U.S. Dollar Equity Index (RSISX USD Index), was up 0.6% for the month, and up 5.9% for the year. The low trading volumes that marked the prior month continued into October, with the average daily turnover at around half the average daily turnover for the prior 12 months.

Just as in the preceding month, the low volumes did not have a negative effect on prices, and the RSISX USD Index traded mostly at the upper end of its medium-term uptrend. Once again, supporting the thesis that the market’s technical picture continues to be positive, and that the RSISX USD Index is continuing with the process of consolidating its gains that started last December, following a blistering 35.9% three-month rally.

While this consolidation could continue over the next few weeks, the likely consolidation or pullback should be within its multi-month uptrend (chart below).

Rabee Securities U.S. Dollar Equity Index and Daily Turnover

(Source: Iraq Stock Exchange, Rabee Securities, AFC Research, daily data as of October 30th.

Note: daily turnover adjusted for block trades)

The RSISX USD Index’s constituents’ performances were a mixed bag, with five stocks up and five down. Positive performances were led by Baghdad Soft Drinks (IBSD), which was up 8.1%, followed by the National Bank of Iraq (BNOI) up 6.5%, Iraqi Islamic Bank (BIIB) up 3.9%, and AsiaCell Telecom (TASC) up 0.5%.

Decliners were led by Commercial Islamic Bank of Iraq (BCOI), which was down 9.1%, followed by Bank of Baghdad (BBOB) down 6.1%, Al-Mansour Pharmaceuticals Industries (IMAP) down 4.7%, Al-Mansour Bank (BMNS) down 4.3%, and the index’s latest constituent Baghdad Hotel (HBAG), that replaced Iraqi for Seed Production (AISP) at the beginning of the month, was down 0.4% in its first month as a member of the index.

Upcoming parliamentary elections, potential political stalemate and the theatrics of violence

The upcoming parliamentary elections on 11th November 2025, the sixth such elections since the U.S. invasion in 2003, will likely mean the continuation of the current low market trading volumes into the next few weeks. The prior elections, irrespective of their results and the dramas that followed each, resulted in peaceful transfers of power from one government administration to another; however, the processes of government formations following each election were full of conflict and extended over many months.

Current media coverage of the upcoming elections is focused on the intense competition between the ethno-sectarian parties contesting the elections and on the potential for political violence leading up to and following the elections. Most will be recalling and looking for parallels with the last elections in October 2021, and their surprising results that led to a 10-month political impasse over government formation that was marked by political violence.

It ended then with a series of theatrics, starting with the multi-week melodrama of an occupation of parliament by the supporters of the Sadrist Movement, the apparent winners of the elections, and counterdemonstrations by the supporters of the Shia Coordination Framework (SCF), the apparent losers of the elections. That climaxed in a night of intense armed conflict in Baghdad’s Green Zone between the two; however, it was immediately followed by a truce of sorts. After which, the Sadrist Movement’s withdrawal from the political process, allowed the SCF to form a government, which within nine months introduced the expansionary three-year budget of 2023-25 and embarked on significant infrastructure developments.

In discounting and looking beyond the post-election drama, it was asserted here at the time, that irrespective of the political conflict and the theatrics of violence, all parties in the conflict, despite their fierce rivalry, have been members of the all-inclusive governments formed following successive elections post the U.S. invasion in 2003. Importantly, as major players in the post-2003 ethno-sectarian political order, all parties built substantial patronage networks, and consequently could risk the loss of the wealth and sources of economic rent created by these networks if their conflict evolved into a violent confrontation. Supporting the assertions were the actions of the equity and the currency markets that discounted and looked beyond the political impasse and violent clashes.

The current political, societal and economic scene is very different from that of 2021-22 as the country is enjoying the fruits of three years of solid stability and strong economic growth. Nevertheless, these elections are fiercely contested by the country’s ethno-sectarian parties, and there is always the potential for political violence, especially the wild card of the Sadrist Movement’s potential re-entry into the political process and with that a repeat of the events following the 2021 elections. However, irrespective of how the current elections play out, even if they echo the events post the 2021 elections, the assertions made here then are still applicable, cemented further by the economic developments over the last three years.

The substance behind these assertions is that while the upcoming elections and their aftermath have major bearings on the country and its economy, yet thier effects, very much like those of oil prices (below), are cyclical in nature, that either amplify or diminish the secular drivers, but don’t alter their long-term effects. The secular long-term drivers of the economy are its economic transformation, in which the over-arching theme, as discussed in the outlook for 2025 is that both of the two key dynamics discussed here often -the cumulative positive effects of the relative stability and structural banking developments- are in the early stages of their transformation of the Iraqi economy, a process that would unfold over the next few years, bringing with it high economic growth that would feed into higher corporate profits, and ultimately higher stock market returns.

Post-elections, while these dynamics should continue to unfold as much as they did in 2023, 2024 and in early 2025, driving non-oil GDP and corporate profits, yet such growth will be from a much higher base, and the growth rate will slow down sharply from the heady rates of 2023 and 2024.

Moreover, the tailwinds of prior strong oil prices are becoming, and will continue to be, headwinds over the next 9-12 months, given current expectations for weaker future oil prices as measured by Brent crude prices (chart below: green line for prior Brent prices, yellow line for future Brent prices). This implies, all things being equal, that the upcoming government will not have the wherewithal to pursue expansionary budgets, unlike the prior one, without the need for debt issuance to augment oil revenues. Yet, the secular positives of the economic transformation should overcome the drag from these cyclical negatives and thus continue to drive the market’s direction.

Market Expectations for Future Oil Prices

As measured by Brent Futures Contacts (USD per barrel)

(Source: Investing.com, AFC Research, U.S. Energy Information Administration (EIA), data as of October 31st)

Over the next few years, the increased need by the government for debt will play a big role in developing the country’s bond market, which, in time, will bring with it “bond market discipline” that has the potential to positively influence the structural imbalances between current and investment spending that were perpetuated in every budget over the last two decades.

Please click here to download Ahmed Tabaqchali’s full report in pdf format.

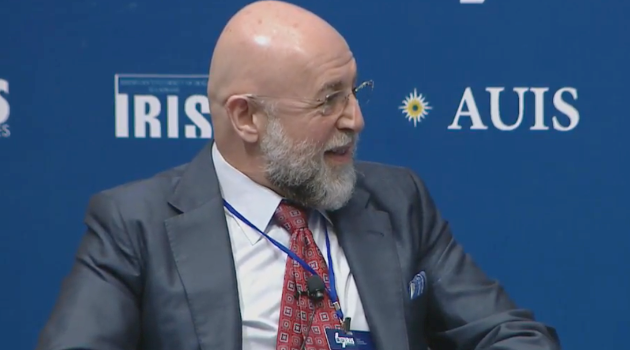

Mr Tabaqchali (@AMTabaqchali) is the Chief Strategist of the AFC Iraq Fund, and is an experienced capital markets professional with over 25 years’ experience in US and MENA markets. He is a board member of Arab Bank Iraq, a Visiting Fellow at the LSE Middle East Centre, Senior Fellow at the Institute of Regional and International Studies (IRIS), and a Senior Non-resident Fellow at the Atlantic Council.

His comments, opinions and analyses are personal views and are intended to be for informational purposes and general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any fund or security or to adopt any investment strategy. It does not constitute legal or tax or investment advice. The information provided in this material is compiled from sources that are believed to be reliable, but no guarantee is made of its correctness, is rendered as at publication date and may change without notice and it is not intended as a complete analysis of every material fact regarding Iraq, the region, market or investment.