The Australian Taxation Office is alerting around 160,000 small businesses to debts placed ‘on hold’ and previously hidden from view, including some long-dormant debts under $10 and others dating back to 2010.

The tax office will not actively claw back those amounts, but taxpayers could face penalties if they ignore those debts for too much longer.

The ATO last week begun sending letters to around 23,000 small business taxpayers regarding their ‘on hold’ debts, which are outstanding payments the ATO considers uneconomical to pursue.

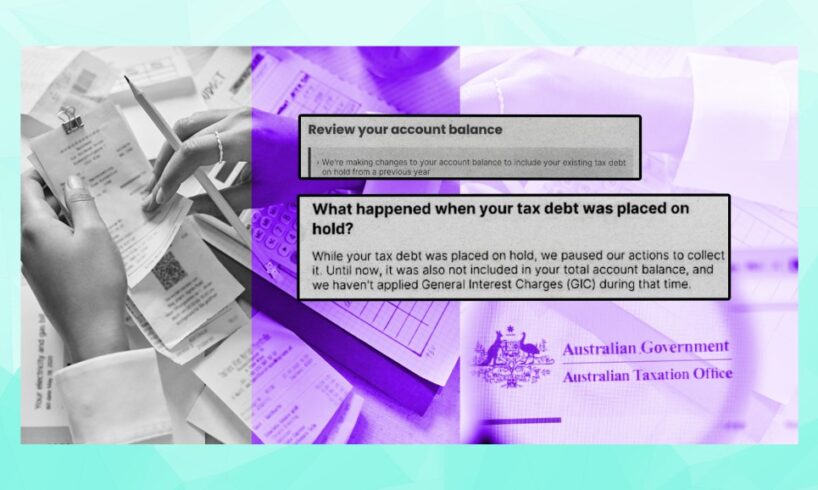

Historically, ‘on hold’ debts did not appear on a taxpayer’s total account balance.

Now, in letters sent to taxpayers and seen by SmartCompany, the ATO says it will start highlighting those ‘on hold’ debts in a taxpayer’s total account balance.

Smarter business news. Straight to your inbox.

For startup founders, small businesses and leaders. Build sharper instincts and better strategy by learning from Australia’s smartest business minds. Sign up for free.

By continuing, you agree to our Terms & Conditions and Privacy Policy.

Related Article Block Placeholder

Article ID: 280453

As a result, some $2.9 billion in ‘on hold’ debts held by small business are expected to appear in account balances.

More than half of those debts are below $5,000, with a median value of $3,450.

Far smaller debts are now under the spotlight.

SmartCompany is aware of debts under $250 and dating to 2010, which were previously considered uneconomical to pursue but are now being listed in account balances.

In another instance, an ‘on hold’ debt totalling $8.65, dating back to 2014, appeared in a taxpayer’s account balance.

Notably, taxpayers might not become aware of those very small ‘on hold’ debts until they visit their account balance, as the ATO is not sending letters discussing amounts under $100.

The ATO’s penalty approach to ‘on hold’ debts

The ATO does not pursue ‘on hold’ debts like it does for live and outstanding debts, which can result in Director Penalty Notices, garnishee actions, and even wind-up proceedings.

“We are not currently taking action to recover” those ‘on hold’ amounts, according to the most recent ATO letter.

Related Article Block Placeholder

Article ID: 321358

The ATO can instead use offsetting, where ‘on hold’ debts listed on a total account balance are passively ‘offset’ by any available tax credits or refunds.

And because those debts will be included in live account balances, they will eventually become eligible for the general interest charge (GIC), a financial penalty applied to taxes that go unpaid past their due date.

The tax office says it will not apply GIC to ‘on hold’ debts for six months after they are listed in account balances, meaning GIC will generally apply from May 2026.

Concern over letter send-out

The ATO made tax professionals aware of the policy in August through its website.

Nevertheless, some tax professionals are now questioning the ATO’s revamped approach and its new letter campaign.

Speaking to SmartCompany, Eddie Griffiths, chairman of the Affiliation for Business Resilience & Turnaround, called the measure “just another crack at small businesses”.

Letters sent to tax agents may put those accountants “even more off-side,” Griffiths said, given the extra workload of verifying small debts from years past.

“Most of the anger has come from the fact that the amounts are so low, that the accountant is like, ‘Well, it’s not even worth putting a complaint it. It’s half an hour on the telephone.’

“The clients are more likely just to pay it, but they’re annoyed that they’re basically being used as a social experiment.”

SmartCompany has contacted the ATO for comment.