Nigeria’s biggest cement producers are showing divergent trends in their trade receivables, revealing how much of their revenues comes from cash versus credit.

An analysis of the financial statements of Dangote Cement, BUA Cement, and Lafarge Africa for the nine months ended September 2025 shows a surge in the money owed to them by customers, suggesting that while cement demand remains strong, a larger portion of sales is being financed on credit rather than cash.

The combined trade receivables of the three cement giants jumped 32 percent year-on-year to N65.2 billion in 9M 2025, its highest in six years.

In contrast, total industry revenue grew by about 40 percent to N4.79 trillion, driven by BUA Cement’s market expansion and Dangote’s pan-African sales.

Read also: Nigeria’s Dangote to invest $1bn in power and cement plants in Zimbabwe

Dangote Cement, which remains the industry leader, posted N54.2 billion in receivables in 9M’25, a jump from N44.9 billion a year earlier. Lafarge Africa also saw its receivables more than double to N10.8 billion from N4.4 billion. BUA Cement, by contrast, maintained a lean receivable position of just N211 million, reflecting its preference for a more cash-oriented sales model.

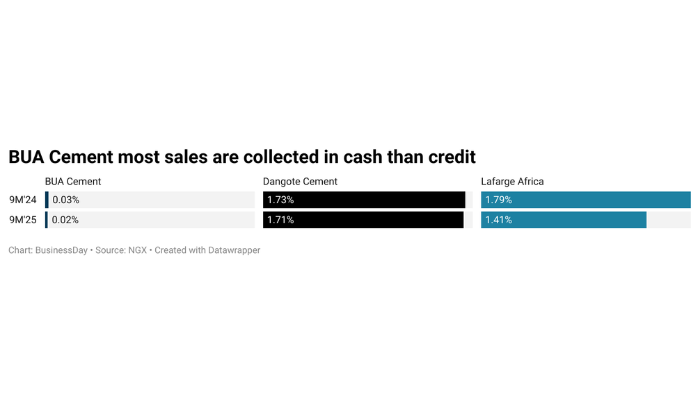

However, the ratio of receivables to revenue, which reveals how much of the sales are yet to be collected in cash, indicates a deeper insight into the underlying liquidity structure.

Dangote’s receivables-to-revenue ratio stood at 1.71 percent in 9M’25, from 1.73 percent in the same period of last year, while Lafarge’s ratio improved slightly to 1.41 percent from 1.79 percent. BUA’s ratio remained minimal at 0.024 percent, highlighting its tighter credit control.

A higher ratio suggests more credit sales, meaning cash takes longer to come in, while a lower ratio signals quicker cash conversion and stronger liquidity.

In this case, the data show that while Dangote and Lafarge have strong market penetration, their revenues are dependent on credit sales. This implies that a notable portion of their top-line figures does not immediately translate to cash flow, potentially affecting their working capital.

BUA Cement’s low ratio of 0.024 suggests most of its revenue is realised in cash, giving it more liquidity flexibility. However, its 2025 cash position of N154.8 billion declined from N185.1 billion in 2024, hinting that even with limited credit exposure, other operational or financing pressures may be weighing on cash reserves.

Adebayo Adebanjo, equity research analyst at CardinalStone Research, said trade receivables are just a function of credit sales, and for the most part, these receivables are recoverable.

“These receivables are usually recoverable, and where they’re not, the extent of impairment is not always so large. It’s just the normal course of business. If you do credit sales, you will always have some impairments from time to time, but that doesn’t mean those amounts are not recoverable.”

Similarly, Gideon Oshadumi, research analyst at Chapel Hill Denham, said receivables have been rising, and it is not necessarily a bad thing, as they normally increase as profitability increases, particularly in a sector like cement.

“Where an increase in receivables becomes a problem is when we see that it does not translate to cash, not just on books but in the cash flow statement,” he said.

Cash flow resilience and liquidity

Despite the rise in credit sales, all three companies reported robust cash flow from operations in 2025. Dangote’s operating cash flow more than doubled to N1.39 trillion from N655 billion, a sign that collections remain relatively efficient. Lafarge also grew its operating cash flow to N109 billion from N46 billion, while BUA improved from N168 billion to N221 billion.

This points to a healthy liquidity cushion, but the growth in receivables raises questions about sustainability.

Oshadumi added that, looking at the data, cash generated significantly outpaced the growth in receivables; this just goes to show that the credit collection process is still solid and sustainable across the board.

“In absolute terms, the amount of increase in receivables is still little compared to the amount of increase in revenue,” he said.

Similarly, a Lagos-based market analyst explained that “while credit sales help sustain market share in an inflationary economy, it exposes firms to counterparty risk and slows the conversion of profits into cash, a crucial factor when input costs and interest rates are rising.”

Read also: BUA Cement profit rises 6-fold on FX gains

Shareholder, profitability implications

From a shareholder perspective, receivable growth can dampen dividend prospects in the short term. Even when profits surge, as seen in 2025 when combined industry profit jumped to N1.24 trillion from N388 billion a year earlier, the ability to pay dividends depends on available cash, not reported profit.

Dangote Cement, which posted N743 billion in profit, may face less immediate concern due to its N204.8 billion cash balance

“Our focus will strongly remain on free cash flow. As long as it remains robust and we continue to see a strong credit collection policy, shareholders’ returns will remain protected,” Oshadumi, research analyst at Chapel Hill Denham, said.

Macroeconomic implication

The broader economic implications are equally significant. Nigeria’s cement industry operates in a landscape marked by chronic infrastructure demand, currency instability, and high interest rates.

High inflation currently stands at 18.02 percent as of September 2025, from the 32.70 percent reported in the same period of last year. The Monetary Policy Rate (MPR), which is the benchmark interest rate, is now at 27 percent.

Despite this, the construction sector’s contribution to real gross national product was 3.60 percent in the second quarter(Q2) of 2025, higher than its contribution of 3.57 percent in the same quarter of the previous year.

This implies that the industry is growing. However, extended credit sales suggest that even corporate buyers such as construction firms and government contractors are grappling with tighter liquidity conditions.