Concerns about an AI bubble have been simmering for at least a year and a half. Nvidia’s incredibly strong earnings this past week tried to put those fears to bed. It may not have been enough.

Nvidia on Wednesday posted sales and profits up more than 60 per cent year-on-year, stronger than Wall Street had projected. CEO Jensen Huang said “sales are off the charts”. And the company expects fourth quarter revenue of about $US65 billion ($100 billion), once again ahead of Wall Street’s projections.

Nvidia executives said these results, along with growth from other major AI players and the billions being poured into AI infrastructure, indicate that fears of an AI bubble are overblown.

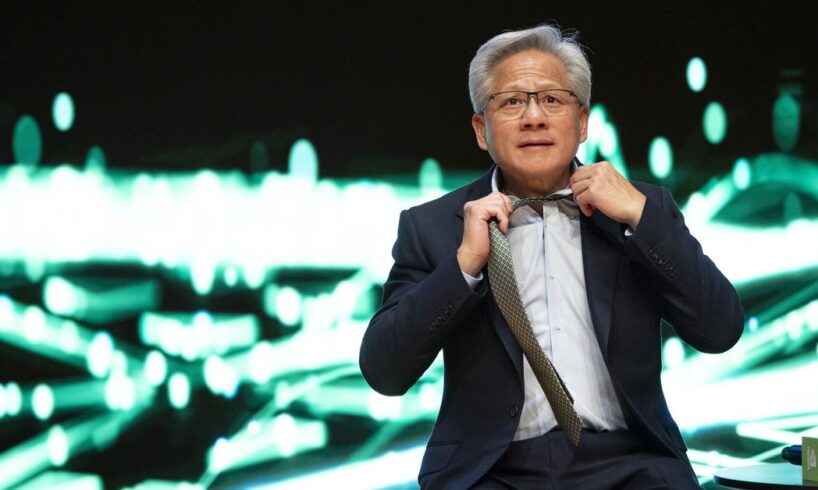

Jensen Huang, NVIDIA founder and CEO, at a Q&A session during the APEC CEO summit in Gyeongju, South Korea. (Getty)

“There’s been a lot of talk about an AI bubble,” Huang said on a call with analysts on Wednesday. “From our vantage point, we see something very different.”

Some Wall Street analysts agree. But the wider market is not yet convinced: After briefly ticking up on Thursday morning following Nvidia’s report, the chipmaker’s shares (NVDA) dipped back into the red. They closed Friday down 1 per cent, although the stock remains up 29 per cent from the start of this year.

In other words, Nvidia answered a lot of questions about where the industry stands right now, but it may take more to shift the overall AI narrative.

Nvidia CFO Colette Kress said the company anticipates $US3 trillion ($4.65 trillion) to $US4 trillion ($6.2 trillion) in annual AI infrastructure spending by the end of the decade, adding that demand “continues to exceed our expectations”. Already, tech giants are expected to pour $US400 billion into AI-related capital expenditures this year, to meet what they say is growing demand for AI and cloud services but also to avoid falling behind industry rivals.

Nvidia has every reason to try to reassure investors — expectations for the company are sky-high after nearly two years of astronomical growth. And many look to the chipmaker as a bellwether for the overall tech industry.

Even as Silicon Valley tries to figure out the business model for generative AI, Nvidia has a big role to fill in the existing tech services people use every day, Huang said. That could help insulate Nvidia even if returns from new AI applications are smaller than expected or take longer to arrive than planned.

US President Donald Trump speaks with Saudi Arabia’s Crown Prince Mohammed bin Salman, Elon Musk, Nvidia CEO Jensen Huang and others at the Saudi Investment Forum. (AP)

“The world has a massive investment in non-AI software, from data processing to science and engineering simulations, representing hundreds of billions of dollars in cloud computing spend each year.” Much of the infrastructure powering that software has transitioned from running on older CPU chips to Nvidia’s GPUs, the chips known for running AI tools, Huang said.

Kress also took the unusual step of ticking through highlights from the chipmaker’s partners’ recent financial reports. At Meta, for example, AI recommendation systems are leading to “more time spent on apps such as Facebook and Threads”. Anthropic recently noted it expects to earn $US7 billion in annual revenue this year. And Salesforce’s engineering team is 30 per cent more efficient now that it’s using AI for coding, she said, among a long list of corporate customers she rattled off.

Nvidia isn’t the only one arguing that AI bubble concerns may be exaggerated.

“The pure Nvidia numbers/guidance and strategic vision shows the AI Revolution is NOT a Bubble…instead its Year 3 of a 10-year build out of this 4th Industrial Revolution in our view,” Wedbush tech analyst Dan Ives said in emailed commentary.

King Charles III presents the 2025 Queen Elizabeth Prize for Engineering to Jensen Huang. (Getty)

Brian Colello, senior equity analyst at investment research company Morningstar, said he doesn’t “see many signs to suggest that 2026 will be a weak year for Nvidia in any way” and sees the bubble fears weighing on the company’s stock as a “buying opportunity”.

But despite those strong results, it appears the stock market may not be ready to relax just yet.

Questions remain about whether tech firms will maintain their massive spending on AI infrastructure, especially as Nvidia has invested in key, unprofitable customers such as OpenAI and Anthropic. OpenAI CFO Sarah Friar also raised alarms earlier this month when she suggested that the government should backstop the debt tech companies are incurring to build AI infrastructure. Some took her comments as a sign OpenAI may struggle to afford its commitments, although the company later tried to walk back the statement.

And while Nvidia likely has enough customers even if a bubble burst causes some casualties among AI firms, investors may still be worried about what a downturn or even a slowdown could mean for the larger market.

“There’s been a lot of talk about an AI bubble,” Huang said on a call with analysts on Wednesday. “From our vantage point, we see something very different.” (Getty)

Daniel Morgan, senior portfolio manager at Synovus Trust Company, said questions about the sustainability of Big Tech’s infrastructure spending spree and Nvidia’s circular funding deals were not “put to rest” with its latest report. Instead, they may just be “punted” to the next quarter.

That means Nvidia almost certainly has more work ahead to convince the world that we’re in for an AI boom and not bust.