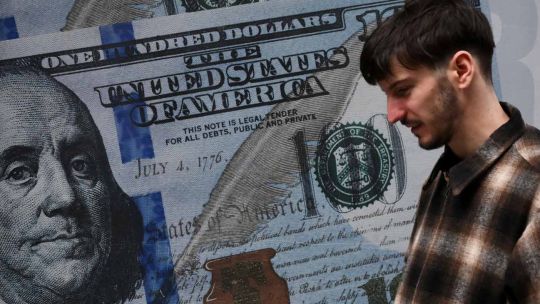

Javier Milei’s Argentina is undergoing a boom in car sales, real estate and flights are fully reserved. But among low-income sectors, consumption has fallen, employment is precarious and supermarket bills are being paid on credit.

The Milei government has slashed inflation from an annual 117 percent last year to 1.6 percent last month while achieving a historic fiscal surplus. But this has come at the cost of devaluing the peso and removing subsidies, making access to housing, health and education more expensive.

The plunging consumption seen in 2024 picked up a bit as from May, but in a fragmented fashion – while the demand for consumer durables from high-income households soared, mass consumption stays rock-bottom.

Nine of 10 households are in debt and 12.8 percent in arrears.

Two faces

“Nothing is being sold,” says Laura Comiso, an employee at a downtown shoe shop.

She’s bored to death by another afternoon without customers.

In contrast, Blas Morales has just had another hectic day as a car salesman in San Andrés de Giles, 110 kilometres west of the capital.

“We had an excellent June” with sales tripling in the last six months, he explains.

The first half of this year has seen 78 percent more cars sold than in the first six months of 2024 – “The best six months in the last seven years,” according to Sebastián Beato, the president of ACARA (Asociación de Concesionarios de Automotores de la República Argentina) car dealers association.

Loans, lower interest rates and tax cuts, promotions and government policies permitting so-called “mattress dollars” to return to the market have all contributed.

Real-estate purchases and sales have also revived, up 22 percent in May in Buenos Aires as against the same month last year.

The first four months of the year saw more mortgages signed than in all 2024, although barely a quarter of lenders could meet requisites of job and income stability.

“The change of government was very positive for this sector,” said Diego Sardano, the third generation of his family to head a real-estate agency in Lanús in the southern suburbs of Greater Buenos Aires, explaining.

“Dollar stability and a supply of credit not available since 2017 have proved favourable. With the previous government we could pass months and months without a sale and now we have five a month,” he added.

It is peaking because “people’s purchasing power is not increasing,” said Sardano.

A strong peso in relation to the dollar favours those who travel abroad but hurts local tourist operators whose reservations have been plunging.

Brazil has become cheap for Argentines and the aeroplanes flying there “take off full,” said Sandra Peliquero, a 30-year veteran of the travel industry.

Between January and April some six million Argentines travelled abroad, 70 percent more than the same period last year, while only two million foreign visitors entered for a drop of 21 percent, the lowest figure in the last decade.

For the few

But only a select group of the population is attending this consumer party in Argentina. Barely six percent belong to the upper class while half are in the lower classes, earning less than US$960 a month.

The middle class, once the main consumer engine, is the worst-hit by the Milei government’s “chainsaw” austerity.

A study by the Moiguer consultancy firm highlights that the economic recovery after months of recession (including an annual contraction of minus 1.8 percent in 2024) does not benefit everybody “and aggravates the current inequality.”

Half the population say that they cannot reach the end of the month while 30 percent postpone or cut out expenses to pay for basic services.

“The licensing of upmarket cars is on the rise while less food is being consumed, sweeping away the middle class,” commented Rodolfo Aguilar, the secretary-general of ATE state workers union, which has suffered the loss of over 40,000 jobs since Milei took office in December 2023.

Having a job does not guarantee reaching the end of the month because “wage recovery is minimal against the aggressive increases in taxation, gas, electricity, transport and schooling,” said Fernando Savore, who heads a federation grouping shopkeepers in Buenos Aires Province.

“Much of the money earned by workers goes on those obligations. Some things are not sold any more like sweets and desserts. People buy the necessary, pasta and tomato purée and nothing more,” he said with many paying on credit.

“As shopkeepers we do not want any more inflation because it knocks us out but now we hope that things sort themselves out.”

related news

by Sonia Avalos, AFP